All Activity

- Past hour

-

With the Bitcoin halving approaching, anticipation grows! In light of this, I caught sight of a discussion about Merlin Chain, a layer 2 protocol. It integrates various technologies like the ZK-rollup network, decentralized oracle, and on-chain BTC anti-fraud module, promising a secure and transparent environment for investors. Led by Bitmap Tech, a reputable team with a market capitalization exceeding $500 million, this project aims to empower Bitcoin assets and protocols on Layer 1 through its Layer 2 network. Its ecosystem also hosts decentralized applications like Izumi Finance, Mobox, Bitmap Game, and Particle Network, adding diversity to the Bitcoin ecosystem. With its listing on CEX like Bitget coming up, what do you think about its potential in the crypto space? (Edited)

-

With the Bitcoin halving approaching, anticipation grows! In light of this, I caught sight of a discussion about Merlin Chain, a layer 2 protocol. It integrates various technologies like the ZK-rollup network, decentralized oracle, and on-chain BTC anti-fraud module, promising a secure and transparent environment for investors. Led by Bitmap Tech, a reputable team with a market capitalization exceeding $500 million, this project aims to empower Bitcoin assets and protocols on Layer 1 through its Layer 2 network. Its ecosystem also hosts decentralized applications like Izumi Finance, Mobox, Bitmap Game, and Particle Network, adding diversity to the Bitcoin ecosystem. With its listing on CEX like Bitget coming up, what do you think about its potential in the crypto space? (Edited)

- Today

-

Se você está pronto para uma aventura emocionante, o Fortune Dragon é o jogo perfeito para você! Neste guia completo, vamos te ensinar tudo sobre como jogar e aproveitar ao máximo este emocionante slot de cassino. Prepare-se para descobrir os segredos do dragão da fortuna e ganhar dinheiro real! 👉CLIQUE AQUI E FAÇA SEU CADASTRO NA PLATAFORMA✅ 🎮 Como Jogar Fortune Dragon? 🌟 O Que É o Fortune Dragon? O Fortune Dragon é um empolgante jogo de slot desenvolvido pela PG Soft, conhecido por suas incríveis recompensas e gráficos impressionantes. 🎰 Como Começar a Jogar? Para começar a sua jornada com o Fortune Dragon, basta fazer o seu cadastro em um cassino online confiável, como o Megapari, e fazer o seu primeiro depósito. 💰 Quais São os Bônus Disponíveis? Ao jogar o Fortune Dragon, você pode desfrutar de incríveis bônus de boas-vindas e até mesmo receber 150 rodadas grátis para aumentar suas chances de ganhar. 👉CLIQUE AQUI E FAÇA SEU CADASTRO NA PLATAFORMA✅ 🤑 Vale a Pena Jogar? Sim, definitivamente! O Fortune Dragon se destaca entre outros jogos de slot, oferecendo uma experiência de jogo única e emocionante. 🐲 Símbolos e Recursos do Fortune Dragon 🌈 Quais São os Símbolos da Sorte? No Fortune Dragon, você encontrará uma variedade de símbolos temáticos, como o dragão, o tigre e o ox, todos trazendo diferentes recompensas. 💎 Quais São os Recursos de Bônus? O jogo oferece diversos recursos de bônus, incluindo multiplicadores e giros grátis, que podem aumentar significativamente os seus ganhos. 💡 Informações Importantes do Jogo 📝 Como Ganhar Dinheiro Real? Para ganhar dinheiro real com o Fortune Dragon, basta fazer suas apostas e formar combinações vencedoras em cada rodada. 🕹️ Como Jogar a Versão Demo? Se você deseja experimentar o jogo antes de apostar dinheiro real, pode jogar a versão demo gratuitamente, para se familiarizar com os recursos e mecânicas. 👉CLIQUE AQUI E FAÇA SEU CADASTRO NA PLATAFORMA✅ 📌 Coisas Para Lembrar Aproveite os bônus: Utilize os bônus oferecidos para aumentar suas chances de ganhar. Conheça os símbolos: Familiarize-se com os símbolos e seus valores para maximizar seus ganhos. Divirta-se: O mais importante é aproveitar a emocionante experiência oferecida pelo Fortune Dragon! Agora que você conhece todos os segredos do Fortune Dragon, está pronto para embarcar nesta emocionante jornada em busca de riquezas! 🐉✨ Meta descrição: Descubra como jogar Fortune Dragon, ganhar dinheiro real e aproveitar bônus exclusivos. Este guia completo apresenta todas as informações necessárias para começar a jogar.

-

JogoLucrativo joined the community

-

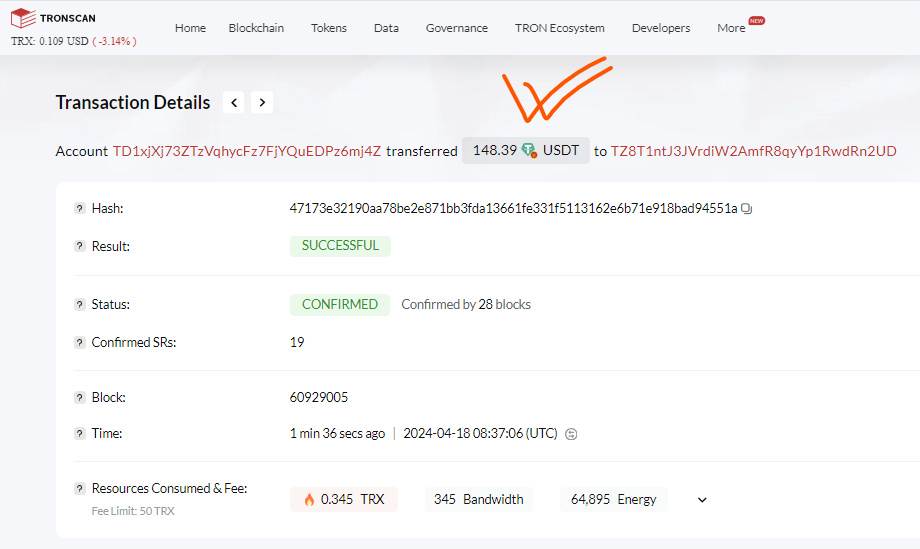

https://tronscan.org/#/transaction/bee851c8b2ab7719895dda16511fafb809593ada7a75b20f47bed25d26d6cd76 5 USDT 2024-04-18 17:19:12 (UTC)

-

Market Movement: ETH's price is currently around $3,263, showing slight variability with minor daily changes. Tech Innovations: Ethereum's recent Cancun-Deneb upgrade marks the beginning of "The Surge" era, focusing on significant enhancements to scalability, efficiency, and security. Community and Events: Anticipation is high with a packed event schedule including ETHGlobal and DappCon, among other global conferences and hackathons, reflecting a vibrant and engaged community. Future Prospects: Analysts are optimistic, with predictions suggesting that ETH could reach as high as $10,000 due to its technical upgrades and growing mainstream adoption.

-

When you are a beginner, it really seems that Forex is an uncertain market. But when you learn to analyze price behavior, see its patterns, study technical and fundamental analysis and create your own trading strategy, the market will become more understandable to you and give you the opportunity to make money.

-

Yes, every trader can have losing trades. But we can control trading risks to minimize these losses. And if your trading strategy gives more correct signals, then in general your trading will be profitable. Non-trading risks can and should also be controlled by choosing a broker with a positive reputation, low commissions and spreads, and ultra-fast execution through a wide range of liquidity providers, such as in fxopen - then your investments will be safer and trading will be more comfortable.

-

I agree. We must systematize our trading, trading only according to the signals of our trading strategy. The rest of the time, we must wait with discipline and not enter the market, no matter how much we would like to start earning money faster. Haste and lack of self-control can ruin our deposit.

-

Gold price reaches fresh high at $2,300 on weak US Dollar In today’s news, the price of gold has surged to a fresh high, reaching $2,300 per ounce, propelled by weakness in the US Dollar. The precious metal’s ascent comes as the US Dollar faces pressure amid concerns about the outlook for the world’s largest economy. The weakening of the US Dollar has been attributed to several factors, including dovish signals from the Federal Reserve regarding interest rates and concerns about the sustainability of the US economic recovery. These factors have eroded confidence in the greenback, prompting investors to seek alternative safe-haven assets like gold. Gold, known for its role as a hedge against inflation and currency devaluation, has attracted renewed interest as investors look to safeguard their wealth amidst uncertain market conditions. The metal’s latest rally underscores its appeal as a store of value in times of economic uncertainty and geopolitical tensions. Furthermore, the ongoing conflict in certain regions, coupled with geopolitical uncertainties, has added to the bullish sentiment surrounding gold. Heightened geopolitical risks often drive investors towards safe-haven assets, providing additional support to gold prices.

-

addeventvn joined the community

-

p3distibuting joined the community

-

dibrov joined the community

-

Since the Start of the Week, Brent Oil Price Has Dropped over 4% At the beginning of the week, March 15, we wrote that the price of Brent oil could form a correction from the resistance level of USD 91 per barrel. Since then, the price has decreased by more than 4% due to a number of factors: → easing concerns about the escalation of the conflict between Israel and Iran. Iran is the third-largest producer in the Organization of Petroleum Exporting Countries, according to Reuters, and easing its conflict with Israel reduces the likelihood of supply disruptions in the Middle East. → reduction in oil consumption. JP Morgan analysts noted this week that global oil consumption in April stood at 101 million barrels per day, 200,000 barrels below forecast. → growth in oil reserves in the USA. Crude oil inventories rose 2.7 million barrels last week, the EIA reported. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer:This article represents the opinion of the FXOpen INT company only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the FXOpen INT, nor is it to be considered financial advice.

-

The Dollar is Corrected after the Comments of the Head of the Federal Reserve Good data on the labour market in the United States and the continuous rise in inflation for several months are helping to reduce experts’ expectations about a change in the vector of monetary policy in the United States. Recent comments from the head of the Federal Reserve confirm the fears of market participants. At a speech at the Wilson Center in Washington on Tuesday, Jerome Powell said: "More confidence will be needed that inflation is moving sustainably toward 2 percent before it is appropriate to ease policy." Such statements undoubtedly should have supported the US currency, but judging by the movement of the major currency pairs, dollar buyers simply need a little respite. GBP/USD At the beginning of the current five-day trading period, quite diverse statistics came from the UK: In February, the unemployment rate increased to 4.2% against the forecast of 4.0% The level of average wages rose to 5.6% versus 5.5% The level of average wages rose to 5.6% versus 5.5% Such indicators allowed pound buyers to find and test support at 1.2400. According to technical analysis for GBP/USD (Japanese candlesticks) on the daily timeframe, we have a bullish engulfing combination. If the price fixes above 1.2480, a corrective pullback for the pair may extend to 1.2540-1.2520. A refresh of the recent low could lead to the start of a new downward impulse in the direction of 1.2330-1.2280. TO VIEW THE FULL ANALYSIS, VISIT THE FXOPEN BLOG Disclaimer:This article represents the opinion of the FXOpen INT company only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the FXOpen INT, nor is it to be considered financial advice.

-

I'm guessing lot of people noticed how Solana have become the playground for memecoin. Considering it's volatility, I will say the memecoin niche has remained lively, with some coins generating significant returns for investors. I've been exploring their memecoin listings, and EPIK, a new meme with a playful duck mascot, has caught my attention. Usually, I've seen a lots of feline and dog coins lately so I believe Its uniqueness coupled with backing from crypto influencers seems to be driving its rising popularity. It has had positive sentiment from online communities and an upcoming listing on Bitget have given EPIK additional attention. On the technical aspect, It's on-chain activity is also picking up steam, with daily TV reaching millions of dollars and the number of holders approaching 10,000. With strong trading volumes and a positive community response, it might be worth keeping an eye on. What do you think of Memecoins in general? Is the volatility worth the risk?

-

Kaminari Click Anti-Fraud Solution

Kaminari Click replied to Kaminari Click's topic in Marketing Tools

Navigate Through Affiliate Marketing Safely with Kaminari Click: Where Clarity Meets Security! 🚨🌐 Hey, Kaminari Click Community! Dive into the deep end of affiliate marketing with us today. Guess what? Not all waters are clear. Some are swirled with the murky clouds of fraud and bots, especially in certain verticals. Let's shed some light on where the shadows lurk the most! 🕵️♂️💡 1. Financial Services. Talking big bucks here – from credit cards to crypto. High payouts mean high stakes, attracting fraudsters like moths to a flame. They’re crafting intricate schemes to fake consumer interest and swipe those commissions. 2. Health & Beauty. This isn’t just about looking good; it’s about dodging the bad. The wellness world, with its fat margins and broad appeal (think weight loss supplements to skincare), is a playground for fraudulent play. 3. E-commerce & Retail. The digital marketplace is bustling not just with shoppers but with shifty characters trying to earn off fake orders or exploiting return policies for a quick buck. 4. Gaming & Apps. Ever heard of bots going on a gaming spree? Well, they're out there, mimicking app installs and in-game achievements to bag rewards they never earned. 5. Dating & Meetups. Love might be in the air, but so are scams. Fake profiles not just break hearts but also rules, tricking platforms into paying out for non-existent love stories. 🔍 At Kaminari Click, we're like the digital Sherlock Holmes for your affiliate marketing efforts. Our tech is finely tuned to sniff out fraud across these murky waters, ensuring your campaigns stay clean, clear, and profitable. 🚀 Don't let the fraudsters muddy your waters. Dive into the clear with https://kaminari.click/. Sign up today and let's keep your traffic safe, your rewards real, and your affiliate journey fraud-free. Because with Kaminari Click, clarity isn’t just an option; it’s a guarantee. #KaminariClick #AffiliateMarketing #FraudPrevention #CleanTraffic -

Daily Forex News by XtreamForex.com

xtreamforex26 replied to xtreamforex.com's topic in 📈 Forex News & Analysis

EUR/USD Stays Above 1.0650 as US Dollar Faces Fresh Sell-Off The EUR/USD currency pair saw a modest increase, reaching 1.0672 in Thursday’s early Asian trading session. This rise was supported by a combination of renewed selling pressure on the US Dollar and a generally risk-acceptant market atmosphere. Key economic indicators set to be released later on Thursday include weekly Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, the CB Leading Index, and Existing Home Sales. These data points are eagerly awaited by investors who are gauging the economic landscape. Despite the upward movement of the EUR/USD, sentiments were tempered by comments from Federal Reserve Chairman Jerome Powell earlier in the week. Powell indicated that recent economic data do not provide much confidence that the Fed’s 2% inflation target will be met soon, suggesting a prolonged period of tight monetary policy which could strengthen the US Dollar in the short term. This hawkish outlook may limit the potential gains for the EUR/USD pair. Market predictions now reflect a nearly 71% expectation for a Fed rate cut in September, as per the CME FedWatch Tool. Conversely, the European Central Bank (ECB) is showing signs of a more dovish policy stance. ECB policymaker Joachim Nagel hinted at a possible rate cut in June, although he acknowledged that inflation rates are still higher than desirable. Furthermore, ECB official Bostjan Vasle proposed that the deposit rate might be reduced to 3% by year’s end, down from the current record high of 4%, provided that the expected disinflation progresses. This potential easing in ECB policy could pressure the Euro and, by extension, the EUR/USD pair. Read More : Daily & Weekly Analysis On Xtreamforex -

I'm writing this post because I've recently discovered something in the web3 space that I wanted to share with you all. There seems to be a lot happening in this space, trying to wrap all these informations in could be somewhat difficult. If there’s want thing I want to fully dive into is being a web3 creator, still learning about Artrade features. I haven't tried it out yet just came across the project on bitget exchange. but from what I've gathered, it seems to offer some intriguing features for artists like us. Fact it’s an all-in-one art platform helping creators like myself sell our work at fair prices and connect with our communities, it’s also designed for digital and traditional artists, curators, collectors and focus on content protection from crypto volatility and fostering connections within the art world. I've heard that you can even create NFT Live from your phone or connected mobile device, adding customizations like GIFs, emojis, filters, and more. It sounds like an innovative way to give your creations a unique touch Anyone had such experience? Or have a better alternative for me ?

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in 📈 Forex News & Analysis

Australian Dollar's Struggle Below EMA 50 Explained Solid ECN – The Australian dollar trades at about 0.644 against the U.S. dollar as of writing, slightly below the broken support level of 0.6455. Interestingly, the AUDUSD 4-hour chart shows a doji candlestick pattern, highlighted in the image above. The Relative Strength Index still hovers below 50, but the Awesome Oscillator bars are green, giving mixed signals. Despite the contradiction between the technical indicators, the primary trend is bearish, and the pair trades below EMA 50. Based on price action analysis, our first bearish signal is the doji candlestick pattern. Therefore, from a technical standpoint, selling pressure will likely increase if the AUDUSD remains below EMA 50. Should the market shift downwards, its initial target would be this week's low of 0.6389. Conversely, EMA 50 is the dividing line between bull and bear markets. The bear market could be considered over if the price crosses and stabilizes above EMA 50. In this scenario, the uptick momentum that began this week at 0.6389 could extend to 0.652. -

Hello, Affiliates! 💜 Welcome back to the Adepti network, where success meets opportunity! We're thrilled to unveil our best offers crafted to supercharge your Facebook advertising campaigns and boost your earnings. 💰 1117 Tajnyzralyflirt CPL CZ [DOI] EPC: $0.42 💰 94 The Local Date CPL US [DOI] EPC: $0.54 Don't miss out on these exclusive Facebook-friendly offers designed just for you! 🤑 Contact your manager today and start maximizing your profits effortlessly. Ready to take your earnings to new heights? Let's make it happen together! 💪

-

Katerina_ODK changed their profile photo

-

Like to chat on Discord? So do we! Spending a few hours with friends, discussing the latest news and laughing at jokes is what we love about Discord. That's why we decided to create our own server! Here we will discuss your favorite tokens, events in the crypto world, as well as tell you about our service and its latest updates, answer your questions and help you get to better know Cryptomus! We can't wait to meet you on this new platform, chat about crypto and have a good time!

-

Katerina_ODK joined the community

-

official Market Update by Solidecn.com

Solid ECN ✔️ replied to Solid ECN ✔️'s topic in 📈 Forex News & Analysis

GBPUSD Sideways Movement: Bearish Signals Despite Consolidation Solid ECN—The GBPUSD currency pair trades sideways between 1.249 and 1.240. The Bollinger Bands are squeezed and demonstrate the range area on the 4-hour chart. Other technical indicators, except Standard Deviation, signal and promise a bullish trend while the uptick momentum is weak, and we don't see strength from the buyers. From a technical standpoint, the primary trend is bearish while the pair hovers below EMA 50 and the Ichimoku cloud. However, the current consolidation phase might test the EMA 50 again in today's trading session, potentially forming a double-top pattern on the 4-hour chart. Consequently, a failure to stabilize the price above 1.2499 will likely lead to a decline, and initially, the pair would test this week's low at 1.240 support. -

HFMarkets (hfm.com): Market analysis services.

HFM replied to HFM's topic in 📈 Forex News & Analysis

Date: 18th April 2024. Market News – Stock markets benefit from Dollar correction. Economic Indicators & Central Banks: Technical buying, bargain hunting, and risk aversion helped Treasuries rally and unwind recent losses. Yields dropped from the recent 2024 highs. Asian stock markets strengthened, as the US Dollar corrected in the wake of comments from Japan’s currency chief Masato Kanda, who said G7 countries continue to stress that excessive swings and disorderly moves in the foreign exchange market were harmful for economies. US Stockpiles expanded to 10-month high. The data overshadowed the impact of geopolitical tensions in the Middle East as traders await Israel’s response to Iran’s unprecedented recent attack. President Joe Biden called for higher tariffs on imports of Chinese steel and aluminum. Financial Markets Performance: The USDIndex stumbled, falling to 105.66 at the end of the day from the intraday high of 106.48. It lost ground against most of its G10 peers. There wasn’t much on the calendar to provide new direction. USDJPY lows retesting the 154 bottom! NOT an intervention yet. BoJ/MoF USDJPY intervention happens when there is more than 100+ pip move in seconds, not 50 pips. USOIL slumped by 3% near $82, as US crude inventories rose by 2.7 million barrels last week, hitting the highest level since last June, while gauges of fuel demand declined. Gold strengthened as the dollar weakened and bullion is trading at $2378.44 per ounce. Market Trends: Wall Street closed in the red after opening with small corrective gains. The NASDAQ underperformed, slumping -1.15%, with the S&P500 -0.58% lower, while the Dow lost -0.12. The Nikkei closed 0.2% higher, the Hang Seng gained more than 1. European and US futures are finding buyers. A gauge of global chip stocks and AI bellwether Nvidia Corp. have both fallen into a technical correction. The TMSC reported its first profit rise in a year, after strong AI demand revived growth at the world’s biggest contract chipmaker. The main chipmaker to Apple Inc. and Nvidia Corp. recorded a 9% rise in net income, beating estimates. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi Market Analyst HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in 📈 Forex News & Analysis

Murrey Math Lines 18.04.2024 (USDCHF, XAUUSD) USDCHF, “US Dollar vs Swiss Franc” USDCHF quotes are above the 200-day Moving Average on D1, indicating the prevalence of an uptrend. However, a divergence has formed on the RSI. As a result, in this situation, a test of the 6/8 (0.9033) level is expected, followed by a breakout and a price decline to the support at 5/8 (0.8911). This decline could be interpreted as a correction of an uptrend. The scenario might be cancelled by a breakout of the resistance at 7/8 (0.9155). In this case, the pair could rise to the 8/8 (0.9277) level. On M15, the lower boundary of the VoltyChannel is broken, which increases the probability of a further price decline. XAUUSD, “Gold vs US Dollar” Gold quotes are above the 200-day Moving Average on D1, indicating the prevalence of an uptrend. However, the RSI is in the overbought area. In this situation, a rebound from 3/8 (2375.00) is expected, followed by a price decline to the support at 2/8 (2250.00). This movement could be interpreted as a correction of an uptrend. The scenario might be cancelled by rising above 3/8 (2375.00), in which case, the quotes could grow to the resistance at 4/8 (2500.00). Read more - Murrey Math Lines (USDCHF, XAUUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team