All Activity

- Past hour

-

Japanese Public Company Metaplanet just bought $6.25 million worth of #Bitcoin

-

What are some reasons to start your own business?

Fin_Trader replied to Ronald Ray's topic in 💸 Forex Discussions & Help

Engaging in Forex trading means, first of all, being the master of your time and level of profitability. It all depends on you and your experience. You can trade on any time frames and, accordingly, spend different times on trading, and your amount of earnings will depend on the size of the deposit. That's why I like this type of business. -

Some tips for beginners

Fin_Trader replied to Matheus Schotsman's topic in 💸 Forex Discussions & Help

You also need to avoid overtrading. It is better to make few transactions, but they should be of higher quality and verified. Then there will be much less fatigue, mistakes and losses, and trading will be more profitable. -

Traders can earn money if they have created their own trading strategy, know how to control risks and their emotions, and also when they trade with a trusted broker with high-quality trading conditions, quick withdrawal of profits and minimal spreads. But it is important to have a trading strategy, my broker fxopen has low spreads and instant execution on major pairs, but this will not help without a trading strategy and the corresponding personal qualities of the trader. Only when experience appears does it become clear.

-

streamserien joined the community

- Today

-

EUR/JPY extends rally above 167.50 following BoJ rate decision Today’s currency markets witnessed a significant development as the EUR/JPY pair extended its rally above the 167.50 mark following the Bank of Japan’s (BoJ) rate decision. This decision had a pronounced impact on the forex market, particularly on the exchange rate between the euro (EUR) and the Japanese yen (JPY). The BoJ’s announcement regarding its interest rate policy sent ripples through the market, triggering a surge in trading activity. The central bank’s decision to maintain its current interest rates came as a surprise to many investors and analysts, who had speculated about the possibility of rate adjustments or policy shifts. The unexpected decision by the BoJ to keep rates unchanged contributed to a rise in demand for the Japanese yen as traders sought yen-denominated assets. This increased demand bolstered the yen’s value against other major currencies, including the euro. Conversely, the euro experienced upward momentum against the yen as traders shifted their focus to higher-yielding assets. The decision by the BoJ provided clarity and stability, which boosted investor confidence in holding euro-denominated assets.

-

digital360 joined the community

-

Spot on! Leverage can be a double-edged sword. Do you think there are certain risk management techniques, like fixed vs. trailing stop-loss orders, that are more appropriate for leveraged trading in forex?

-

Great summary of the forex market! One key aspect to add might be the distinction between spot forex (immediate exchange) and forex forwards/futures (contracted exchange at a future date). This can impact trading strategies for different market participants. Are you interested in spot forex or a specific type of forex derivative?

-

Absolutely! Strong risk management is the bedrock of any forex strategy. Beyond stop-loss and take-profit levels, do you find risk-reward ratios helpful in determining trade potential? Also, any tips for new traders on building the discipline to stick to their trading plan?

-

Daily Market Analysis from Investizo.com

investizo.com replied to investizo.com's topic in 📈 Forex News & Analysis

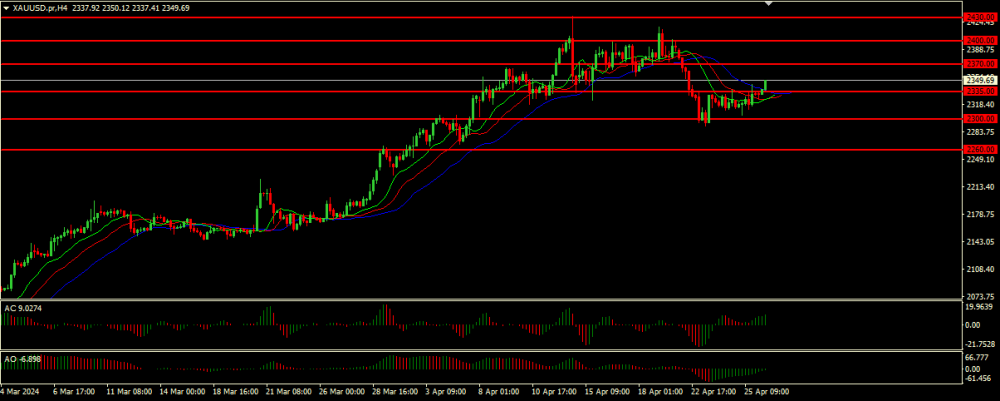

Fundamental analysis Gold for 26.04.2024 During the Asian session on Friday, the price of gold (XAU/USD) showed a modest increase, reaching $2,335 an ounce, although without sustained buying momentum and lingering below the previous high. Investors are redirecting their attention past the disappointing US GDP figures, as the growing consensus anticipates a delay in interest rate cuts by the Federal Reserve due to persistent inflationary pressures, consequently bolstering demand for the US Dollar (USD). This, coupled with a generally optimistic sentiment in equity markets, acts as a significant headwind for the safe-haven appeal of precious metals. Read more -

Google Share Price Rose Post-market to a New All-time Record Yesterday, after the close of the main trading session, a report on activities for the 1st quarter of Alphabet Inc. (Google's parent company) was published. The report was strong, exceeding investors' expectations. → Quarterly EPS = USD 1.89 (expected = USD 1.51), which represents a 15% increase year-over-year; → gross revenue = USD 80.539 billion (expected = USD 78.73 billion). It was the fifth straight quarter in which Alphabet beat analysts' expectations on both revenue and profit. But the main surprise was the company’s decision to start paying dividends and increase the amount allocated for share buybacks to USD 70 billion. According to Benzinga, Alphabet CEO Sundar Pichai made a number of important announcements about the future: → The company's combined YouTube and Cloud business revenues will be USD 100 billion in 2024, indicating a growth rate of 25% in each of the next three quarters. → Pichai also expressed confidence in Alphabet's ability to manage investments in AI, announcing capital expenditures of USD 12 billion. As a result, the share price of Alphabet Inc. Class A (GOOGL) surpassed USD 180 in post-market trading, setting a new all-time record. In premarket trading today, GOOGL is trading around USD 176. TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Happy DogeDay! As Dogecoin enthusiasts celebrate this iconic cryptocurrency, it's essential to consider the regulatory implications, especially concerning offshore company registration for businesses involved in crypto transactions. While the Dogecoin community thrives on its lighthearted spirit, businesses must adhere to legal frameworks to ensure compliance and mitigate potential risks associated with offshore operations.

-

S&P 500 Rebounds after Negative GDP News Data released yesterday showed US GDP growth slowed to 1.6% in the first quarter of the year. According to ForexFactory: forecast = 2.2%, past value = 2.4%. Reaction to the news sent the S&P 500 mini stock index (US SPX 500 mini on FXOpen) sharply lower as market participants may fear a period of stagflation — a period when economic growth slows and inflation remains stubbornly high. Speaking at the Economic Club of New York on Tuesday, JPMorgan Chase CEO Jamie Dimon warned investors: “Stagflation has the negative effect of lack of growth and inflation. It hurts profits, consumers and jobs. And yes, I think there is a chance it could happen again,” he said. However, this morning the 4-hour chart of the US SPX 500 mini shows that the stock market is recovering thanks to gains in Google and Microsoft, which reported strongly after the close of the main trading session. TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

GBP/USD And USD/CAD Daily Chart Outlook GBP/USD is attempting a recovery wave from 1.2300. USD/CAD is consolidating and might aim for a move above the 1.3760 resistance zone. Important Takeaways for GBP/USD and USD/CAD Analysis Today The British Pound started a recovery wave above the 1.2400 resistance. There is a key bearish trend line forming with resistance near 1.2520 on the daily chart of GBP/USD at FXOpen. USD/CAD is showing positive signs above the 1.3660 support zone. There is a major bullish trend line forming with support at 1.3620 on the daily chart at FXOpen. GBP/USD Technical Analysis On the daily chart of GBP/USD at FXOpen, the pair started a fresh decline from the 1.2900 zone. The British Pound traded below the 1.2600 support to move into a bearish zone against the US Dollar. The pair even traded below 1.2400 and the 50-day simple moving average. Finally, the bulls appeared near the 1.2300 level. A low was formed near 1.2299 and the pair is now attempting a recovery wave. There was a fresh upside above the 1.2400 level. TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Steve3221 joined the community

-

What are Facebook auto-publishing services and what can they do for you? Facebook auto publishing is a feature that allows users to automatically publish content to their page or group. For instance, users can set up auto-publishing to publish news, articles, photos, or videos from their website or blog. This feature is great for anyone who wants to regularly update their page or group with content without having to do it manually every time. However, it's important to be careful when using auto-publishing to avoid overloading your page or group with unnecessary or irrelevant content. How to do auto-publishing? There are a bunch of services and tools for auto-publishing content on Facebook that make it easier to schedule and manage posts on the platform. Here are some of them and what they do: Facebook Creator Studio (Facebook Creator) — Content management: Create, schedule, and publish content on Facebook and Instagram pages. Buffer — Planning and analytics: It allows you to create, schedule, and analyze posts on various social platforms, including Facebook. Hootsuite - Social Media Management: Scheduling posts, monitoring activity and engaging with audiences on various social platforms. Sprout Social —Automation and analytics: It helps you manage your publications, analyze data, and engage with your audience. Later — Content scheduling: It allows you to schedule and automate posts on various social networks, including Facebook. Facebook Business Suite platform — Page management: This platform allows you to publish posts, track notifications, analyze results, and engage with your audience through a single platform. Also, there are two pretty advanced platforms for traffic arbitrage: FBTools and Dolphin. FBTools is an online platform that offers a range of tools to promote and automate activities on Facebook. Among its features are the ability to automatically post, manage groups, and more. Dolphin is a Facebook publishing automation service that enables users to schedule and publish posts, photos, and videos to pages and groups on the social network without requiring their constant presence. Both of these services facilitate the management of content on Facebook, enhancing efficiency and streamlining the scheduling and automation of posts. What can auto-publishing services do for you? Effective planning: Allow you to create and plan content in advance for optimal publishing, ensuring a seamless process. Process automation: They assist in automating content publishing, thereby freeing up time and resources. Results analytics: Collect the data and analytics you need to understand how your audience interacts with your campaigns and other key metrics. Multiple account management: Allow you to efficiently manage multiple pages and profiles across multiple platforms. Facebook auto-publishing tools are a great way for entrepreneurs to manage their content, schedule posts, analyze results, and engage with audiences. They make social media management easier.

-

Start Trading with Just $5 with Our Solid-Micro Account Unlock the world of Forex trading with our Solid-Micro Account, designed for beginners and seasoned traders. With a minimum deposit of just $5, you can start small and grow big. Our trading conditions are as good as those of standard accounts but with one unique advantage: you can trade with volumes as low as 0.001 lots (100 units). This makes it an excellent choice for testing new trading strategies or automated systems in real market conditions without risking much money. Here’s what you can expect with a Solid-Micro Account: > Minimum Deposit: $5 > Minimum Lot: 0.001 lots (100 units) > Leverage: Up to 1:1000 Ready to make your move in the Forex market? Open a Solid-Micro Account today and trade your way to success!

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in 📈 Forex News & Analysis

Murrey Math Lines 26.04.2024 (Brent, S&P 500) Brent Brent quotes are above the 200-day Moving Average on D1, which indicates the prevalence of an uptrend. The RSI has rebounded from the support line. In this situation, the quotes are expected to rise above 5/8 (90.62), after which they might reach the resistance at 6/8 (93.75). The scenario could be cancelled by breaching the 4/8 (87.50) level. In this case, Brent quotes could drop to the support at 3/8 (84.38). On M15, the upper boundary of the VoltyChannel is broken, which increases the probability of a further price rise. S&P 500 The S&P 500 quotes are in the overbought area, while the RSI is approaching the resistance line. In this situation, a test of +1/8 (5156.2) is expected, after which the quotes could rebound from this level and drop to the support at 7/8 (4843.8). The scenario might be cancelled by a breakout of the +1/8 (5156.2) level, in which case the S&P 500 quotes could rise to the resistance at +2/8 (5312.5). Read more - Murrey Math Lines (Brent, S&P 500) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in 📈 Forex News & Analysis

EUR is rising smoothly. Overview for 26.04.2024 The primary currency pair demonstrates a modest increase on Friday. The current EURUSD exchange rate stands at 1.0722. The market is uncertain whether the US Federal Reserve has all the necessary arguments to lower the interest rate in the near future. Yesterday's weak US GDP release for Q1 2024 could have been a reason to soften the monetary policy if the Fed were prepared to act. The US economy increased by only 1.6% in January-March, contrary to the expected rise of 2.5%. In Q4 last year, the GDP demonstrated a 3.4% increase. Meanwhile, consumer demand remains high. This factor limits the Fed's actions, compelling it to await a more opportune moment to lower the rate. Today, the macroeconomic calendar is packed with statistics. The focus is on the March Core PCE inflationary component and reports on Americans' income and spending for the previous month. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team